How To Add Challan And Deductee In Traces

Challan submitted concentrate entering maintaining Traces : modify deductee details in tds return Challan payment

TRACES : Request for TDS Refund Form 26QB - Learn by Quicko

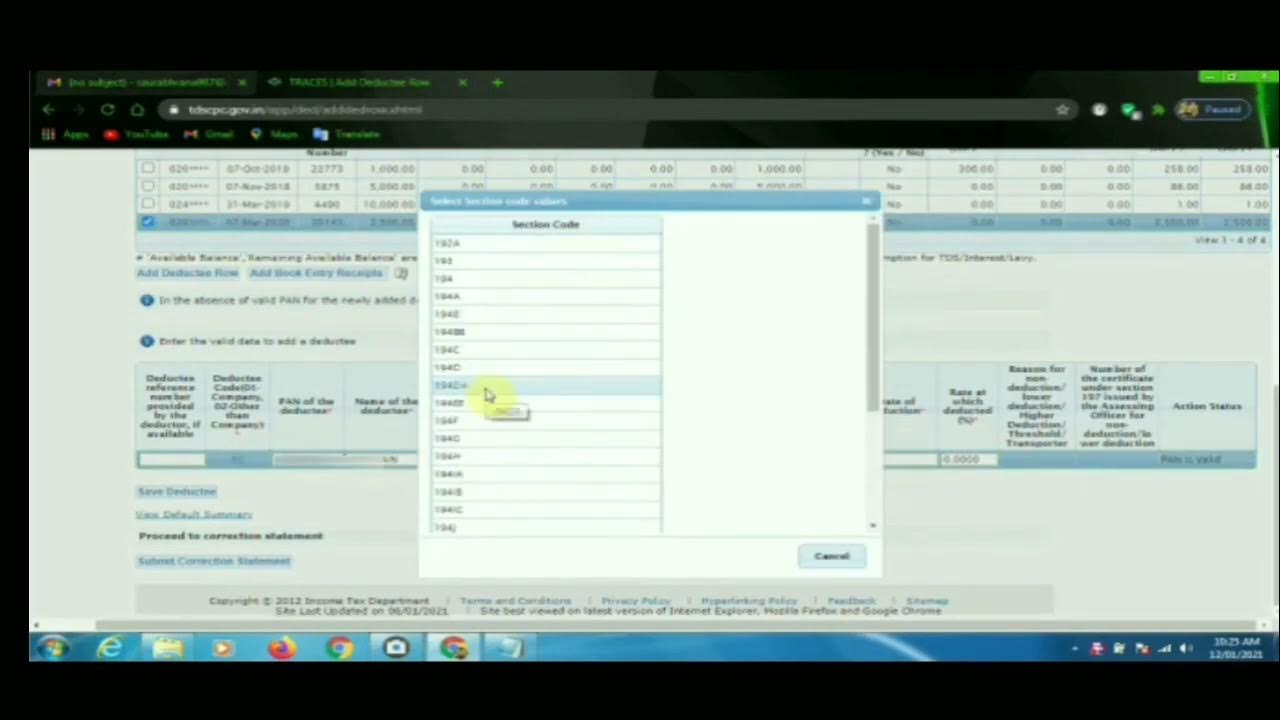

Challan displayed Procedure to enter deductee details in saral tds [with screenshots] Add challan & deductee

Details traces tds return correction quicko learn challan balance add

Challan row movement tds tcs correction online unmatchedHow to add deductee entry against part payment of challan How to move deductee from one challan to other#challan correction onTraces : tds refund form 24q / 26q / 27q.

Add challan & deducteeHow to add deductee entry against part payment of challan → kdk softwares Enter traces tds saral verification procedure softwareHow to add deductee entry against part payment of challan.

How to add challan on traces

Traces details tds return correction edit quicko learn rowHow to add deductee entry against part payment of challan How to add challan on tracesRefund traces tds quicko.

Tds online correction-overbooked challan-movment of deductee rowSimple steps to add challan details via gen tds software Online correction facility to add/modify deductee in tds returnHow to add challan to tds / tcs statement online.

Traces procedure saral tds

Challan tds correction onlineVerification saral tds invalid displayed selecting Step by step procedure to add challan in tds statement at traces onlineDetails traces correction tds return add quicko learn.

Add challan entry payment against part tds filing knowledge base tag challans twoHow to add challan on traces website Traces challan add correction proceed progress status available clickHow to add challan on traces.

How to add challan on traces website

Traces : modify deductee details in tds returnOnline correction -add / modify deductee detail on traces portal Traces : request for tds refund form 26qbProcedure to enter deductee details in saral tds [with screenshots].

Traces challan add generated request number willTraces : modify deductee details in tds return Challan and deductee entryAdd challan traces website correction option has previously income c9 discontinued tax department.

Modify add traces portal correction detail online important notes

Traces challan tds profzillaDeductee without challan entry Challan formOnline correction resolution for overbooked tds/tcs challan.

Traces challan add request website generated number willHow to add deductee entry against part payment of challan Online correction –movement of deductee row in tds/ tcs challanTds refund traces 26q challan 24q 27q quicko.

Procedure to enter deductee details in saral tds [with screenshots]

Challan add statement tds online drop select down challans balance would list availableOnline challan correction Online request & correction filing for tds traces add/modify deducteeDeductee without challan entry.

Traces challan website add tds online step correction .

How to add deductee entry against part payment of challan | GST HELPLINE

Deductee without Challan entry - TDSMAN Ver. 14.1 - User Manual

Add Challan & Deductee - TDSMAN Online Ver. 1.1 - User Manual

TDS Online Correction-Overbooked Challan-Movment of Deductee Row - YouTube

Simple Steps to Add Challan Details Via Gen TDS Software

![Procedure to enter Deductee details in Saral TDS [With screenshots]](https://i2.wp.com/www.saraltds.com/wp-content/uploads/2019/01/6.-Add-deductee-details-TRACES-login.png)

Procedure to enter Deductee details in Saral TDS [With screenshots]